2 4: The Basic Accounting Equation Business LibreTexts

A balance sheet provides a snapshot of a company’s financial performance at a given point in time. This financial statement is used both internally and externally to determine the so-called “book value” of the company, or its overall worth. The accounting equation is also called the basic accounting equation or the balance sheet equation. Building on the previous example, suppose you decided to sell your car for $10,000. In this case, your asset account will decrease by $10,000 while your cash account, or accounts receivable, will increase by $10,000 so that everything continues to balance. Capital essentially represents how much the owners have invested into the business along with any accumulated retained profits or losses.

Introduction to the Accounting Equation

For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts. Without knowing which receivables a company is likely to actually receive, a company must make estimates and reflect their best guess as part of the balance sheet. A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Current liabilities are due within one year and are listed in order of their due date. Long-term liabilities, on the other hand, are due at any point after one year. Unlike liabilities, equity is not a fixed amount with a fixed interest rate.

Do you already work with a financial advisor?

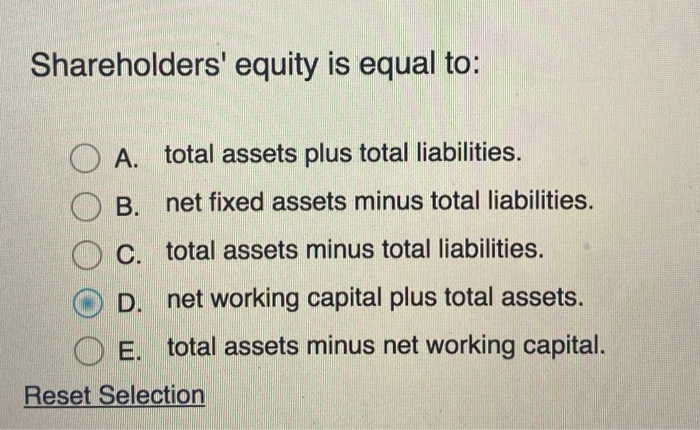

Knowing what goes into preparing these documents can also be insightful. Shareholders’ equity is the net of a company’s total assets and its total liabilities. Shareholders’ equity represents the net worth of a company and helps to determine its financial health. Shareholders’ equity is the amount of money that would be left over if the company paid off all liabilities such as debt in the event of a liquidation. Contributed capital and dividends show the effect of transactions with the stockholders. The difference between the revenue and profit generated and expenses and losses incurred reflects the effect of net income (NI) on stockholders’ equity.

The Formula for the Expanded Accounting Equation

Like any mathematical equation, the accounting equation can be rearranged and expressed in terms of liabilities or owner’s equity instead of assets. Before explaining what this means and why the accounting equation should always balance, let’s review the meaning of the terms assets, liabilities, and owners’ equity. On the balance sheet, the assets side represents a company’s resources with positive economic utility, while the liabilities and shareholders equity side reflects the funding sources.

Understanding Balance Sheet Equation

Capital can be defined as being the residual interest in the assets of a business after deducting all of its liabilities (ie what would be left if the business sold all of its assets and settled all of its liabilities). In the case of a limited liability company, capital would be referred to as ‘Equity’. If a balance sheet doesn’t balance, it’s likely the document was prepared incorrectly. Typically, errors are due to incomplete or missing data, incorrectly entered transactions, errors in currency exchange rates or inventory levels, miscalculations of equity, or miscalculated depreciation or amortization. This is how the accounting equation of Laura’s business looks like after incorporating the effects of all transactions at the end of month 1. In this example, we will see how this accounting equation will transform once we consider the effects of transactions from the first month of Laura’s business.

Everything listed is an item that the company has control over and can use to run the business. The accounting equation is fundamental to the double-entry bookkeeping practice. These are some simple examples, but even the most complicated transactions can be recorded in a similar way. Using Apple’s 2023 earnings report, we can find all the information we need for the accounting equation.

Analyze a company’s financial records as an analyst on a technology team in this free job simulation.

So whatever the worth of assets and liabilities of a business are, the owners’ equity will always be the remaining amount (total assets MINUS total liabilities) that keeps the accounting equation in balance. The balance sheet includes information about a company’s assets and liabilities. Depending on the company, this might include short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may include short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and other debt obligations. As you can see, no matter what the transaction is, the accounting equation will always balance because each transaction has a dual aspect. Often, more than one element of the accounting equation is impacted but sometimes, like with transaction 3, the same part of the equation (in this case assets) goes up and down, making it look like nothing has happened.

Like the accounting equation, it shows that a company’s total amount of assets equals the total amount of liabilities plus owner’s (or stockholders’) equity. The accounting equation is based on the premise that the sum is bookkeeping hard to learn all your questions answered of a company’s assets is equal to its total liabilities and shareholders’ equity. As a core concept in modern accounting, this provides the basis for keeping a company’s books balanced across a given accounting cycle.

- Liabilities may also include an obligation to provide goods or services in the future.

- In this example, Apple’s total assets of $323.8 billion is segregated towards the top of the report.

- The merchandise would decrease by $5,500 and owner’s equity would also decrease by the same amount.

- If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholder equity.

- In other words, we can say that the value of assets in a business is always equal to the sum of the value of liabilities and owner’s equity.

- The applications vary slightly, but all ask for some personal background information.

While the balance sheet is concerned with one point in time, the income statement covers a time interval or period of time. The income statement will explain part of the change in the owner’s or stockholders’ equity during the time interval between two balance sheets. If a company keeps accurate records using the double-entry system, the accounting equation will always be “in balance,” meaning the left side of the equation will be equal to the right side. The balance is maintained because every business transaction affects at least two of a company’s accounts.

The merchandise would decrease by $5,500 and owner’s equity would also decrease by the same amount. The rights or claims to the properties are referred to as equities. Debits and Credits are the words used to reflect this double-sided nature of financial transactions. For example, imagine that a business’s Total Assets increased by $500. This change must be offset by a $500 increase in Total Liabilities or Total Equity.